Illicit Trade

Globally, about 12% of the cigarette market is illicitly traded, making it equivalent to 657 billion cigarettes annually and $47.4 billion lost in revenue.

Nigeria ratified the Protocol to Eliminate Illicit Trade in Tobacco Products in March 2019, becoming the 51st country to do so.In spite of this, Nigeria is listed among 25 countries, including seven from Africa, that are the main hubs for illicit trade in tobacco and tobacco products.

This page provides information on the illicit tobacco trade in Nigeria, shows the players and drivers of the illicit trade market, and the mode of movement of illicit products.

Illicit tobacco trade is a global problem that undermines the public health gains of tobacco control policies and the outcomes of the WHO Framework Convention on Tobacco Control (WHO FCTC).

To address the issue, the Parties to the WHO FCTC adopted in 2021 the Protocol to Eliminate Illicit Trade in Tobacco Products, an international treaty with the objective of eliminating all forms of illicit trade in tobacco products through a package of measures to be taken by countries acting in cooperation with each other: it is a global solution to a global problem.

In addition to the availability of cheap cigarettes that fuel addiction and consequent health impacts, illicit trade in tobacco is a form of tax evasion that results in revenue losses for a country.Around 43 billion cigarette sticks are illicitly traded in Africa each year.

In Sub-Saharan Africa, illicit trade in tobacco results in annual tax losses of around $10 billion. The illicit trade share in Nigeria is around 25%. Nigeria produced 17.53 billion sticks in 2018 from where 585 million sticks were exported (equivalent to 3.3%) (Figure 1). In the same year, approximately 71 million sticks were imported into the country, which means 17.016 billion cigarette sticks are available for the local market.However, assuming that there were approximately 7.64 million daily smokers who smoked an average of 8.3 sticks per day in Nigeria;

according to GATS 2012, the total demand for cigarettes would be about 23.1 billion per annum. This would give an unexplained surplus, interpreted as the size of illicit cigarette trade, of about 6.084 billion sticks of cigarettes (i.e., about 26% of the total market share) illegally consumed in Nigeria.Demand and Supply of cigarettes in Nigeria in 2016

Data source: CSEA(2020)

If 20 per cent of the market in Nigeria is being held by counterfeiters and illicit cigarette dealers, then it would mean that Nigeria lost about N1.5 billion in 2017– based on estimates.

Centre for the Study of the Economies of Africa.

The major tobacco companies – British American Tobacco Nigeria and International Tobacco Company Limited – produce approximately 80% of the tobacco products consumed in Nigeria.

A 2019 tobacco study that compared the variation between licit and illicit market segments puts the average retail price of illicit cigarettes at N100 in 2018, compared to N180 for imported cigarettes, N150 for lowest-price locally manufactured cigarettes, N200 for the mid-price domestic brand, and N250 for the premium brands. The illicit cigarette trade reduces the effectiveness of tobacco control policies, and especially the tobacco tax policies; hence the need to control it. Studies have shown that a reduction in illicit trade would contribute to a reduction in tobacco consumption and improve the fiscal and health outcomes of tobacco control interventions in Nigeria.

Nigeria is the most populous country, and one of the leading tobacco markets, in Africa, with 17 billion cigarettes sold annually, costing Nigerians over US$ 931 million (2019).

The illicit tobacco trade in Nigeria is driven by supply and demand factors. On the demand side, the cheapness of the illicit tobacco products and consumers’ addiction to tobacco fuel demand. On the supply side, members of the industry and illicit producers seek to circumvent taxes, which they do not pay on illicit products, thereby making high profits with a low risk of being caught and penalized.Illicit tobacco tends to thrive in countries with weak regulatory frameworks, inefficient customs and border management, a failure to adopt technological advances in logistic management, and an availability of informal distribution networks. These are risk factors that allow illicit trade to succeed in Nigeria.

The sale of cigarettes in single sticks also contributes to illicit trade as it makes it difficult to track illicit cigarettes and trace the origin of cigarette purchases.

Because illicit trade operates outside regulated channels, the cheap illicit tobacco products can be easily obtained by minors who should not smoke or be exposed to products containing nicotine. The presence of illicit tobacco products on the market complicates the progress of campaigns to prevent youth access and addiction to tobacco products. Evidence also points to non-price factors as the major drivers of illicit tobacco trade.

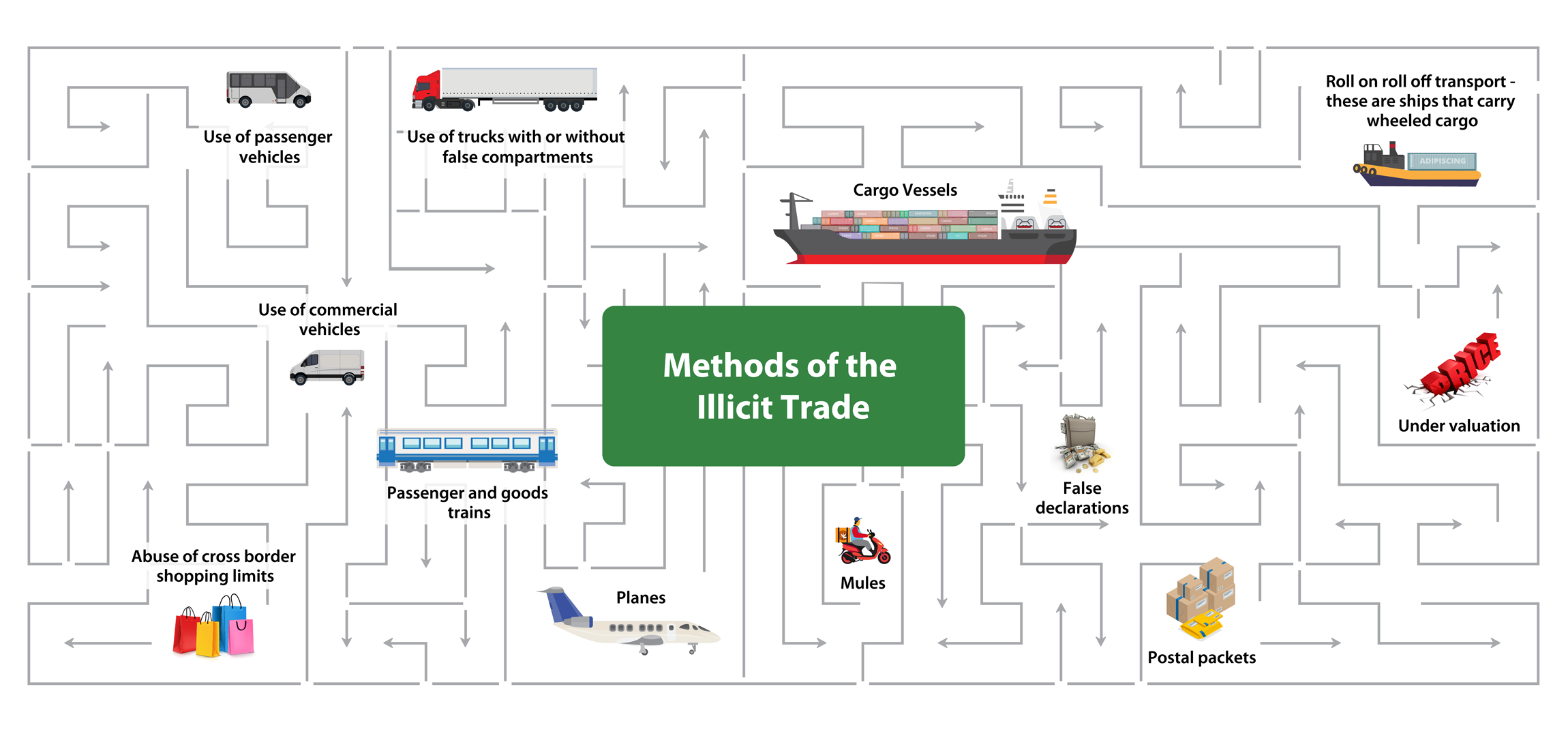

Illicit methods

Globally, it is estimated that 600 billion cigarettes pass through the black market before they reach consumers.

The Financial Action Task Force (FATF) report on illicit tobacco states that the methods that are used to smuggle the illicit tobacco across different countries include the elements as presented in the illustration below:

A United Nations Office on Drug and Crime (UNODC) report put the value of cigarettes smuggled into Africa at US$774 million.

Illegal tobacco products enter the Nigerian market through the porous borders and then are traded on the black market. Counterfeit tobacco products also enter the Nigerian markets from imports, complemented by local companies who counterfeit existing products and distribute them in the market without the knowledge of licensed producers.

Different systems of illegal tobacco trade

In Nigeria, there are various systems that enable the illegal trade of tobacco. They include:

Poor Monitoring of Cargo Vessels

Poor Monitoring of Cargo Vessels

Illicit tobacco products ultimately targeted at the Nigerian market are shipped using false bills of lading for other commodities. Sometimes there are shipments without consignees or shipments to countries with inefficient regulatory or law enforcement bodies. Consignments of illicit tobacco targeting the Nigerian market mostly berth at the seaports in the Republic of Benin and Togo, and the contents are subsequently moved by smugglers into Nigeria.

Abuse of Nigeria’s Duty-Free Policy

Abuse of Nigeria’s Duty-Free Policy

Smugglers often abuse the duty-free policy that allows Nigerians to carry “200 cigarettes or 200 grams of tobacco” that is foreign-manufactured for their personal consumption. Smugglers often solicit the assistance of non-smokers to bring in illegal quantities of tobacco products.

Activities of Licensed Tobacco Producers

Activities of Licensed Tobacco Producers

Even though not quantifiable, licensed companies bring in illicit products known as illicit whites or cheap whites. These are cigarettes legally produced in one jurisdiction for the sole purpose of being exported and illegally sold in a jurisdiction where they have no legitimate market. These cigarettes may not meet the health and manufacturing regulations of the destination country. Applicable duties and taxes are usually evaded as they often fail to disclose the entirety of their imports and exports.

Legitimate tobacco companies profit even when their products are sold in the illegal market. A British Broadcasting Corporation (BBC) documentary revealed that tobacco multinationals were breaking rules in Nigeria, Malawi and Mauritius; for example, tobacco companies claim that they do not promote the sale of single stick cigarettes, but there are posters in Nigeria depicting single stick cigarettes and displaying the price of a single cigarette.Activities of Unlicensed Tobacco Producers

Activities of Unlicensed Tobacco Producers

Due to the largely unregulated local market, unregistered companies receive illicit tobacco and sometimes produce counterfeit tobacco products that are sold in Nigeria. There are reported cases of unlicensed companies engaging in counterfeit operations in Nigeria. It is also not impossible that licensed tobacco companies may tacitly support illicit trade in an effort to limit their tax liabilities. A 2014 investigation

uncovered a non-existent firm – Cigarette and Tobacco Kano Co. Ltd. – with a fake address, said to have been selling cheap cigarettes in northern Nigeria and mimicking international brands. It is believed that many of such unlicensed companies are involved in the illicit tobacco trade in Nigeria.Weaknesses of Tax Administration

Weaknesses of Tax Administration

African economies, with their weaker governance structures, are more susceptible to regulatory capture. The 2014 investigation of the illicit tobacco market in Nigeria reported enforcement and regulatory lapses as the key factors fostering illicit trade.

Global experiences indicate the important role of technology in stemming illicit trade.

Use of the tax stamp and track-and-trace marker systems that enable unique identifiers to be placed on each cigarette pack limits tobacco industry participation in illicit activities.

Technology can also support effective border policing by enabling a wider coverage with limited custom official presence. Even at the official border posts in Nigeria, the absence of scanner machines and reliable electricity supply creates gaps for illicit trade to flourish.

Romania

Romania improved tobacco-control enforcement and reduced illicit trade. In early 2010, 19% – 30% of tobacco in Romania was purchased on the illicit market. To combat this, Romania took steps to improve the enforcement of tobacco-control policies. In the first phase, from 2010 to 2012, they aimed to:

- create a better legislative framework;

- strengthen the administrative capacity of Customs; and

- focus on specific and more effective controls to curb cigarette smuggling.

By the end of 2013, the size of the illicit market had decreased to 11.4% of the total market.

Kenya

Over the years, Kenya has demonstrated effective strategies and the political will to curb illicit trade. Kenya reduced the size of its illicit cigarette market from 15% in 2003 to 5% in 2016.

This was achieved through a comprehensive strategy that included sticking tax stamps on cigarettes for domestic consumption, the licensing and registration of cigarette producers and importers, the coordination of implementing agencies, the implementation of a track and trace system, and increased enforcement and penalties for those involved in the illicit tobacco trade.Approaches Implemented in Kenya to Reduce Illicit Tobacco Trade

Paper Tax Stamps

Introduction of paper tax stamps on all cigarettes sold in the domestic market and improved enforcement efforts.

Source: Illicit Trade in Nigeria, Center for the Study of Economies of Africa (CSEA)